Rasi Bhadramani

REIT returns outpaced gains in broader markets for the second straight week on the back of strong quarterly earnings from major names.

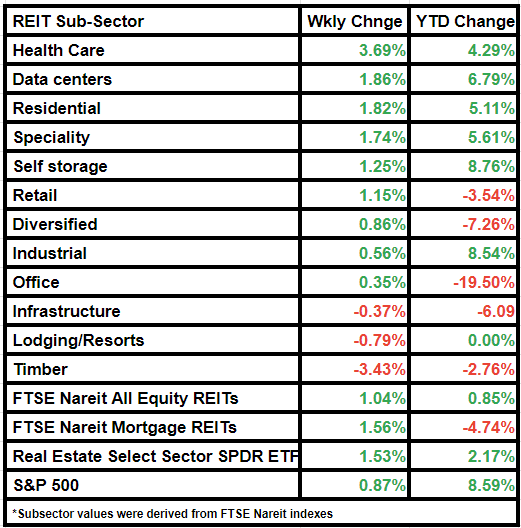

FTSE Nareit All Equity REITs rose 1.04% from last week, while the mortgage REITs index increased by 1.56%.

Comparatively, S&P 500 was up by a mere 0.87%.

The broader real estate index was up by 1.53% on a weekly basis.

REIT returns benefitted from major names posting positive quarterly earnings.

Telecommunications-focused multinational REIT American Tower (AMT) posted a Q1 beat, boosting FY23 guidance considering favorable impacts from foreign-currency exchange rate fluctuations.

Net lease REIT W. P. Carey (WPC) and mortgage REITs AGNC Investment (AGNC) and Annaly Capital Management (NLY) also exceeded Wall Street expectations.

This comes as major indices gain as a result of solid results from major technology names and favorable inflation data.

Notably, Medical Properties (MPW) missed Wall Street consensus, but the health care segment was the biggest gainer of the week.

The segment rose by 3.69% from last week.

Data centers and residential followed, but timber REITs were major laggards. The subsector fell by 3.43% on a weekly basis.

Here is a look at the subsector performance: